Wow, May was THE month alright. Look at the returns for May. Everything were red except for US bonds. May was the worst month for the major asset classes since the dark days of February 2009. Virtually everything suffered with more than trivial losses. Treasuries were the exception, thanks to the revived rush to safety.

Stocks around the world led the decline, with foreign developed markets posting the biggest loss among the major asset classes. What changed the sentiment so sharply in May? A renewed fear of deflation was one catalyst. Investors are increasingly focusing on the growing burden of debt that weighs on the global economy, particularly in the mature countries of Europe, Japan and the U.S.

We may have avoided another Great Depression but we now have the The Winter of Euro-Discontent. To a large extent, we can say that this is more localised than the subprime mess. In another angle, the Eurozone crisis is a different version of the US/UK subprime mess as well.

The US and UK governments acted swiftly to contain the mess, by rescuing dubious companies that cannot be allowed to fail. The US government can print money liberally and even with an enlarged debt, the US is still the US. Not so for many of the governments in the Eurozone. If Greece was the US, Greece would not have been under such a spotlight. It would have been able to print its way out of its troubles.

What is real is we are going to see a long period of deflation within Eurozone, with equally weighty weights on the Euro currency, and other independent European currencies. Public debt or sovereign debt inhibits movements in or grandiose monetary policies. While they have to placate foreign buyers of the attractiveness of their bonds, they are hamstrung by not being able to do deficit-stimulus. Unemployment and social unrest will only climb.

All this will mean that other countries may be wanting to delay tightening, such as the US, China and a host of more vibrant emerging markets. When investors compare the EU with the rest of the world, its obvious. Then you STILL have a low interest rate regime everywhere, in fact a prolonged low interest rate environment - that will cause funds (now on the sidelines) to pour into the US and other emerging markets. The more EU plays out the cards they were dealt with, the more optimistic I am of a strong equity market for the US and emerging markets in 3Q and 4Q.

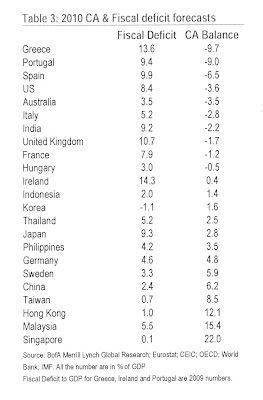

Technically, Japan is in a more difficult position with a huge fiscal deficit but they still have a current account surplus, and that should be the key in estimating the probable recovery by EU countries in crisis. Watch their current account movements and signs of improvement will mean they are on the mend. Well, we all know that that is not going to happen till 4Q2010 if not later.

As a side note, Malaysia looks impressive with its strong current account surplus, and owing to our deficit-stimulus funding, our fiscal deficit is a bit high but not exceedingly so. Being an emerging market economy, it would be wise to bring the fiscal deficit down gradually over the next 3 years.

No comments:

Post a Comment