--------------------

Fed Funds Rate Versus Discount Rate - the federal funds rate is the interest rate at which private depository institutions (mostly banks) lend balances (Federal funds) at the Federal Reserve to other depository institutions, usually overnight. It is the interest rate banks charge each other for loans.

The interest rate that the borrowing bank pays to the lending bank to borrow the funds is negotiated between the two banks, and the weighted average of this rate across all such transactions is the federal funds effective rate.

The federal funds target rate is determined by a meeting of the members of the FOMC which normally occurs eight times a year about seven weeks apart.Another way banks can borrow funds to keep up their required reserves is by taking a loan from the Federal Reserve itself at the discount window. These loans are subject to audit by the Fed, and the discount rate is usually higher than the federal funds rate. Confusion between these two kinds of loans often leads to confusion between the federal funds rate and the discount rate. Another difference is that while the Fed cannot set an exact federal funds rate, it can set a specific discount rate.

------------------------------

That said, the discount rate will effectively move the fed funds rate in the same direction. This move by the Fed was predicted back in January, and as argued, this is a bullish sign rather than a negative one.

Wednesday, January 20, 2010

Bernanke's Likely Weapon Of Choice

This is my prediction for Bernanke. He will raise fed funds rate very very soon. Just because of that, it does not mean that it will be bad for equity markets.

But lets go back to why it will happen very soon (by February I think). Most developed nations' central banks have been reluctant to move the low interest rates regime up because the Main Street has been showing nascent growth. What Bernanke wants to see are corporate spending on R&D and hiring - both not really evident yet. Despite the tons of liquidity being poured into markets, many banks are just sitting by idling.

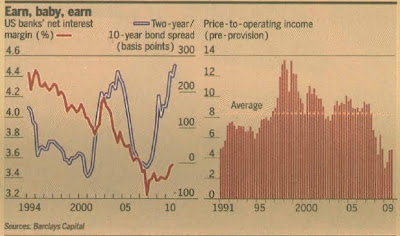

The Fed has had to maintain a low fed funds rate for obvious reasons, but look at the chart, banks are earning very decent net interest margins by lending to the system, and not to clients. High ranking officials have been calling the banks to lend more aggressively, but that does not seem to be working.

Bernanke's hands are being tied a lot more now that many of the banks which received funds from the government are returning it - that means the government will have a lot less leverage to "move the banks" toward certain persuasions.

It looks like Bernanke will have little choice but to close the gap and raise fed funds rate. When net interest margins start to shrink, then the banks will have to put the money to work. The summary from all this deduction is that don't be worried when Bernanke raises fed funds rate, in fact it is a new bullish sign.

p/s photo: Erika Sawajiri

No comments:

Post a Comment